IVDR/MDR Regulations Extended to Combat Medical Device Supply Shortage

Recently, a significant development has come to pass concerning the implementation of the EU’s new medical device legislation. Last week, 16 February 2023, the European Commission shared its intent to extend the MDR and IVDR deadlines. This decision comes as a result of concerns surrounding disruptions to medical device supplies.

Such concerns exist not only among Member States but also among members of the European Parliament and industry stakeholders alike. Ultimately, the goal of this initiative is to gradually delay the transition period for in vitro diagnostic medical devices and medical devices alike. This means many things, for example, one major change eliminates the previously implemented ‘sell-off’ deadline. The extension applies to every medical device put on the market before and during the transition period, as well as those in the supply chain.

Exploring Key Elements of The Proposal

- Medical devices under a certificate/declaration of conformity issued before 26 May 2021 now have a transition period extending from 26 May 2024 to 31 December 2027 for high-risk devices. For medium and low-risk devices, it extends to 31 December 2028. (Only devices that are safe and have taken steps to transition will benefit from the added time)

- The proposal provides a transition period lasting until 26 May 2026 for class III implantable custom-made devices so manufacturers gain the time needed to obtain certification from a notified body.

- The validity of certificates issued up to 26 May 2021 (the day the Medical Devices Regulation first applied) extends to reflect the transition periods introduced by these amendments.

- The commission hopes to abolish the current ‘sell-off’ date for MDR/IVDR, ensuring that safe and necessary medical devices currently on the market will remain for those in need.

Which Rules Apply to Legacy Devices?

At this point, you’re likely wondering which of these rules apply to legacy devices. In terms of the MDR, the transitional period and rules for legacy devices exist in Article 120(3) and are as follows:

- Extended until 2027 for Class IIb and III devices and until 2028 for unclassified Class I and II devices. These extensions are both modified from their original 26 May 2024 deadline.

- Provides a conditional extension of the validity period for CE certificates of the Medical Devices Directive and Active Implantable Medical Devices Directive, as long as:

- Devices don’t present unacceptable health and safety risks.

- Devices haven’t undergone major design changes or intended purposes.

- Manufacturers have already taken steps to launch the certification process under the MDR.

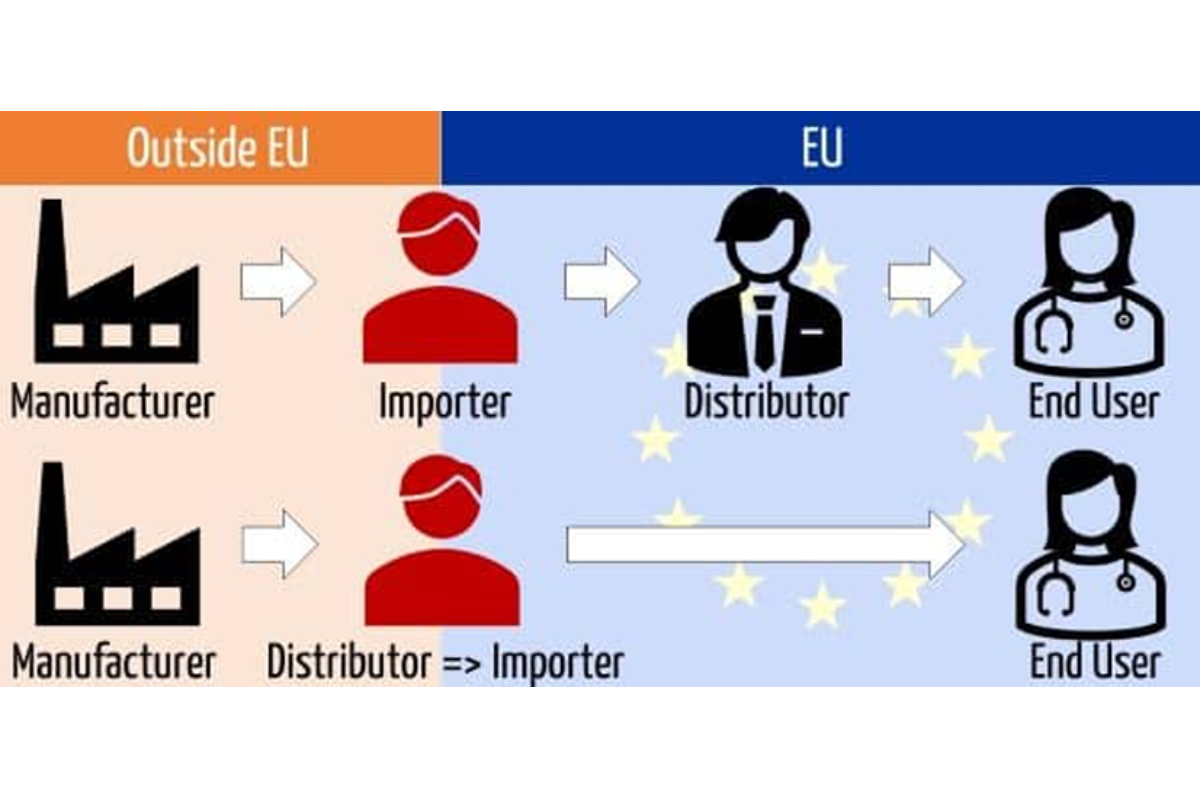

- Should a medical device manufacturer possess an MDR-compliant product between 26 May 2021 and 26 May 2024, it must designate an importer—which Growth Imports is happy to provide. Manufacturers must run two parallel quality management systems which match the registration, tracking, and other requirements according to the MDR.

- Per Article 123(3), legacy devices with a valid certificate qualify for sale as long as, after the date of this regulation, they continue complying with all directives and there are no major changes in either their design or intended purpose.

- Medical device manufacturers must comply with Article 13 (obligations on the importer) and Article 14 (obligations of the distributor).

Concerning the IVDR

- Removal of the ‘sell-off’ provision found in Article 110(4), currently permitting In Vitro Diagnostic Medical Devices Directive certified devices for withdrawal on 27 May 2025.

How Should Medical Device Manufacturers Respond?

As a result of this proposal, medical device companies have until 2027 or 2028 (depending on risk classification) to effectively adapt and meet MDR/IVDR regulations. Moving forward, manufacturers should apply for a derogation under Article 97 if their MDD/AIMD certificates have expired.

Alternatively, this is a requirement if, ahead of that expiration, no written agreement for conformity assessment under MDR with a notified body was in place. Finally, manufacturers might consider Article 97 if their certificate(s) are likely to expire in under six months.

If you fail to meet Article 97 MDR applications, Article 59(1) is ideal for application to each competent authority. Additionally, the application submitted should be ‘in the interest of the public,’ with successful applications that encompass medical devices with no alternatives on the market. Ideally, medical device manufacturers must use this time to place devices subject to the above provisions on the market before the deadline. In turn, they can continue circulating afterward.

What’s Next for The Medical Device Industry?

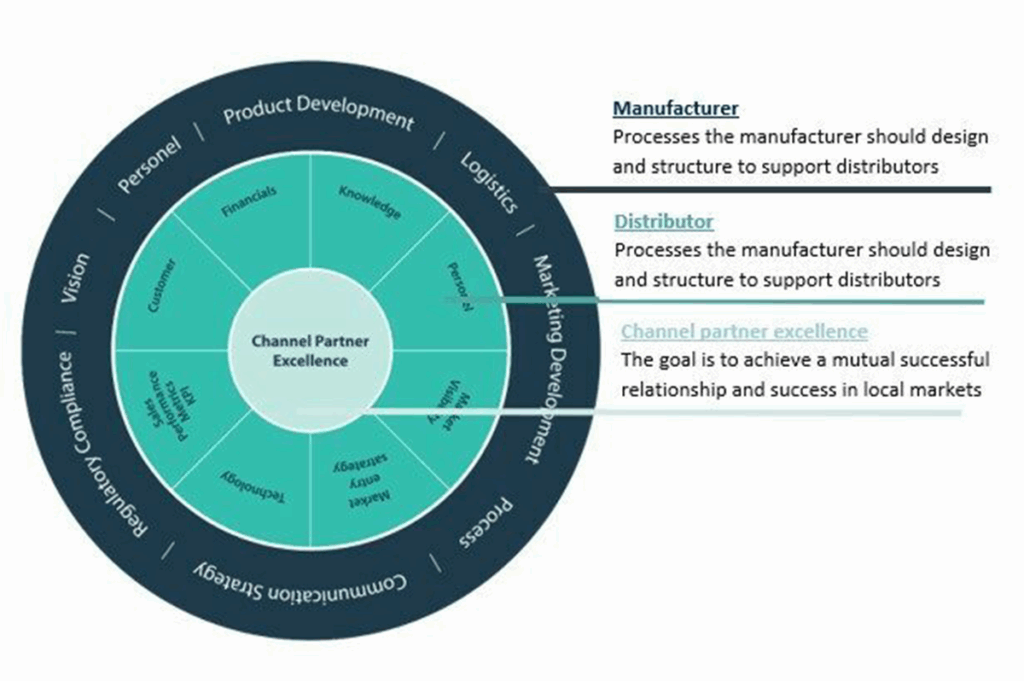

Following the adoption of this proposal, companies must continue transitioning to MDR/IVDR as soon as possible. That way, they can focus on improving and marketing products. Furthermore, there might be future bottlenecks with notified bodies while the new deadlines grow closer. So, companies that are ready to transition can improve and increase marketing efforts for MDR/IVDR-compliant products on a global scale.

As it stands today, the deadline for lower-risk Class I and Class II devices is to 31 December 2,028, and 31 December 2027 for high-risk devices. And remember–if you’re in a need of a market scan, email us or book a meeting to access one at no cost to you.