Selling Medical Devices to European Hospitals

The European hospital purchasing landscape offers significant opportunities for manufacturers and distributors of medical equipment. As a growing and diverse market, Europe is an essential target for companies aiming to expand their presence. However, navigating this complex market requires strategic planning, understanding of funding structures, and familiarity with local procurement processes.

At GrowthMedics, we have helped global medical device manufacturers establish and expand their presence in European hospitals and clinics. Whether you’re exploring tenders, setting up distribution networks, or entering new markets, we can support you every step of the way. If you are looking to expand, feel free to book a meeting with us here or contact@growthmedics.com.

How Are Hospitals In Europe Funded?

European hospitals operate under diverse funding models depending on their classification as public or private institutions:

- Public Hospitals: Primarily funded by:

- Government budgets

- Statutory insurance systems

- Private Hospitals: Supported by:

- Private health insurance

- Charities and non-profit networks

This mix of funding creates opportunities for selling hospital equipment to both public and private facilities, with public hospitals often having larger budgets due to public funding.

Key European Hospital Statistics

Europe’s hospital infrastructure continues to grow, presenting opportunities for companies offering medical equipment. On average healthcare represents 10% of GDP in European countries and about a third of their expenditure. There is a light trend towards centralizing hospitals and increasing beds over building new hospitals. The number of European hospital beds will continue to grow over the next years. The EU is ageing offering long-term opportunities for medical device companies and healthcare providers.

Key statistics include:

- Number of Hospitals: 24,200 hospitals in 2024, with projections of 24,217 by 2025.

- Hospital Beds: Growth from 2.4 million in 2018 to a projected 4.596 million beds by 2025.

- Bed Density: Europe averages 5.49 beds per 1,000 people.

- Demographics: With 20% of the population aged 65+ (expected to rise to 31.3% by 2050), demand for healthcare services and devices is set to grow.

Top Markets by Bed Count: Germany, Austria, Hungary, Czech Republic, and Poland lead in hospital beds per capita.

Hospital Revenue Leaders in Europe

The largest hospital revenues in Europe are generated by prominent hospital groups such as:

- Germany: Fresenius Helios, Rhön-Klinikum, Asklepios, and Sana Kliniken.

- Nordics: Capio.

- Italy: Gruppo San Donato.

These groups dominate the European hospital sales landscape and represent critical opportunities for device manufacturers.

Navigating European Tendering Processes

Public hospitals across Europe follow structured tendering processes for high-value equipment contracts. This acts as the main purchasing platform for equipment, meaning that hospitals are required to follow a tendering process before placing an order.

When it comes to the UK, the NHS tendering process is vast and can be confusing for first timers. According to stipulations, contracts with thresholds lower than the Official Journal of the European Union (OJEU) are allowed to be quoted directly.

Key highlights of the EU tendering landscape include:

- Tender Options:

- Open Procedures: Accessible to all qualified suppliers.

- Restricted Procedures: For pre-approved vendors.

- Competitive Dialogue: For complex contracts requiring negotiation.

- Thresholds:

- Contracts exceeding €428,000 follow EU Directive 2009/81/EC.

- Below this threshold, direct quotes may apply depending on the country.

For a more detailed procurement threshold guide, you can take a look at this link

UK Specifics:

The NHS tendering framework is complex and often requires suppliers to navigate both national and regional procurement systems. For high-value contracts exceeding the OJEU threshold, tenders are mandatory.

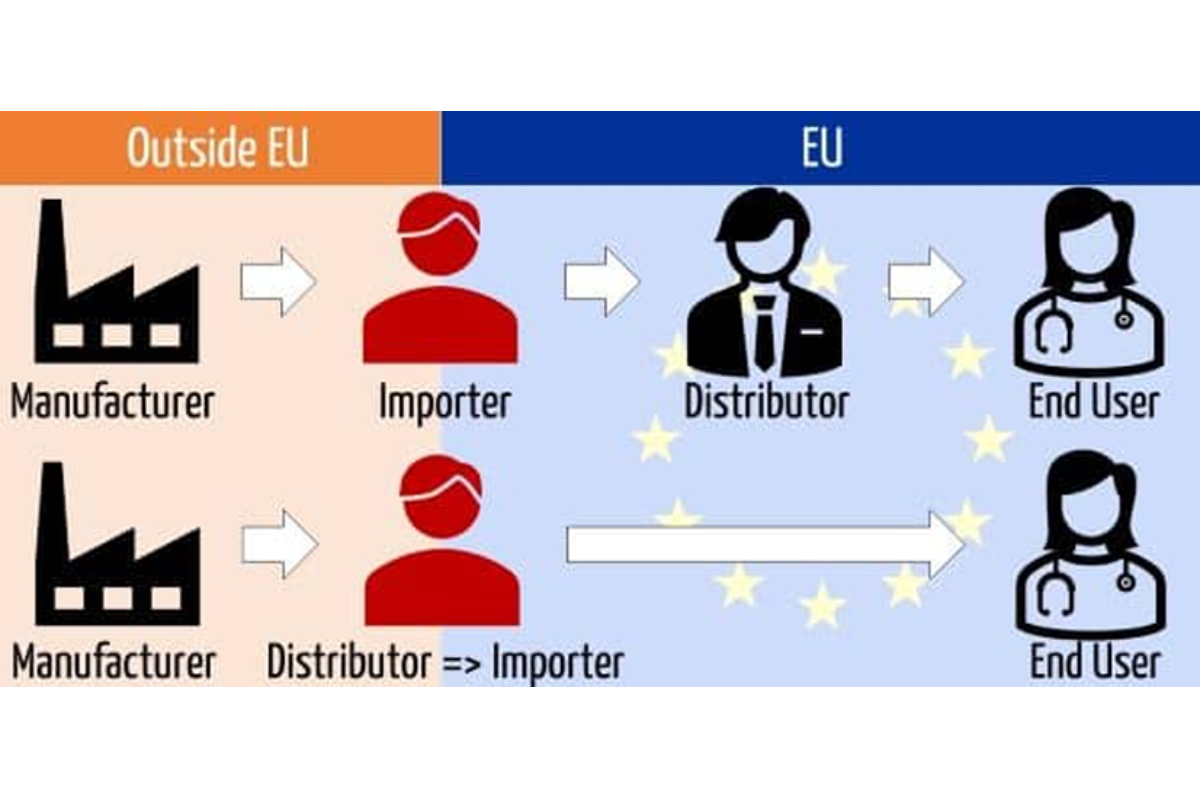

Selling Medical Equipment to EU Hospitals as a Non-Native Manufacturer

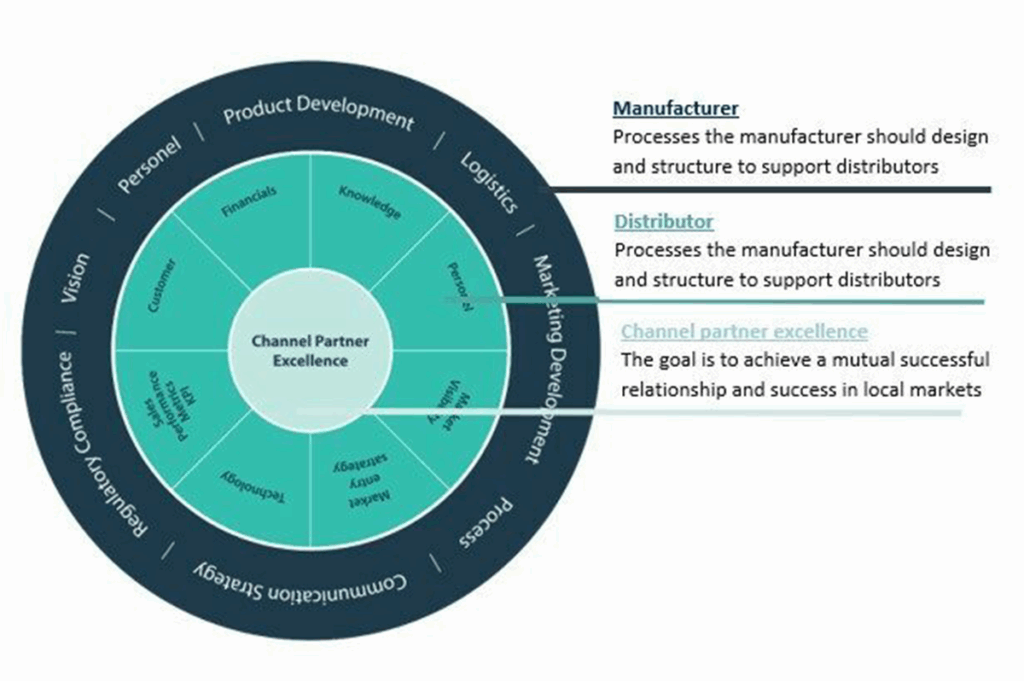

1. Importance of Local Distributors

Having a local distributor is essential for accessing hospitals, navigating regulations, and establishing trust. Local partners can:

- Fulfill service requirements in tenders.

- Facilitate compliance with domestic regulations.

- Build relationships with hospitals more effectively.

2. Choosing the Right Markets

Focus on public hospitals for larger budgets and greater purchasing power. Key countries for selling medical equipment to hospitals include:

- Germany: Largest hospital market with extensive private ownership.

- France: Specializes in advanced diagnostic and surgical equipment.

- Italy and Spain: Known for growing hospital infrastructure.

Opportunities in Hospital Bed Manufacturing and Equipment Sales

Europe’s hospital bed market and related equipment present unique opportunities for manufacturers:

- Hospital Bed Manufacturing: Countries like Germany and Hungary lead in production.

- Diagnostic and Surgical Equipment: Rising demand due to an aging population and advancements in medical technology.

With over 24,000 hospitals and increasing healthcare expenditure, Europe is a prime market for selling diagnostic equipment and hospital supplies.

Conclusion

The European hospital purchasing landscape is diverse, competitive, and full of potential for growth. Success requires understanding the complexities of public procurement, tendering processes, and local distribution partnerships.

At GrowthMedics, we specialize in helping companies expand into European hospitals, ensuring compliance, building strategic partnerships, and maximizing market opportunities. Let us help you achieve your global growth objectives.

Contact us today to learn more about our services or schedule a meeting to discuss your specific needs.