Expanding into international markets like Europe and the Middle East offers tremendous growth potential for medical device manufacturers. However, success in these regions hinges on various critical factors, including pricing strategies for distributors, logistics and distribution planning, and selecting the right distributor.

In this article, we’ll explore the intricacies of learning to master medical device distribution, focusing on pricing considerations and expenses, logistics and distribution planning, and finding the ideal distributor for your products.

Pricing Strategies for Distributors

Pricing plays a pivotal role in the distribution of medical devices in international markets. Manufacturers should be deliberate in their pricing strategies, ensuring they align with market dynamics and the needs of their distributors. Here are some pricing strategies to consider:

- Cost-Plus Pricing: This straightforward strategy involves adding a markup to the manufacturing cost to determine the distributor price. It offers transparency but may not optimize profit margins.

- Market-Oriented Pricing: Manufacturers set prices based on market conditions, considering factors such as demand, competition, and local economic conditions. This approach can maximize revenue but requires continuous market analysis.

- Value-Based Pricing: Prices are determined by the perceived value of the medical device in the market. It requires a deep understanding of the unique value proposition of the product and how it addresses the specific needs of healthcare providers.

- Skimming or Penetration Pricing: Manufacturers can opt for skimming by setting higher initial prices and gradually reducing them as market penetration increases. Conversely, penetration pricing entails starting with lower prices to quickly gain market share.

Factors to Consider in Pricing for Distributors

Pricing for distributors in international markets is a complex task. Several factors need to be taken into account:

- Market Differences: Prices should be adjusted to account for variations in market conditions, regulatory requirements, and customer preferences in different countries within the target region.

- VAT and Import Duties: Manufacturers must consider the impact of Value-Added Tax (VAT) and import duties in the target market, as these can significantly affect the final pricing.

- Market Size: Smaller markets might require higher prices to achieve profitability, while larger markets might allow for lower margins due to economies of scale.

- Distributor Investment: Distributors that invest heavily in marketing, sales, and after-sales support may be more flexible in terms of pricing, as they are likely to demand more favorable pricing.

- Sales Cycles: Understanding the length and complexity of sales cycles in a particular market is crucial. Longer sales cycles may necessitate higher distributor margins to compensate for the extended time to close deals.

Depending on the complexity, market volume, level of niche, sales cycle, market efforts, activity expectations are all part of setting a fair margin that is competitive and provides the distributor with attractive growth opportunities.

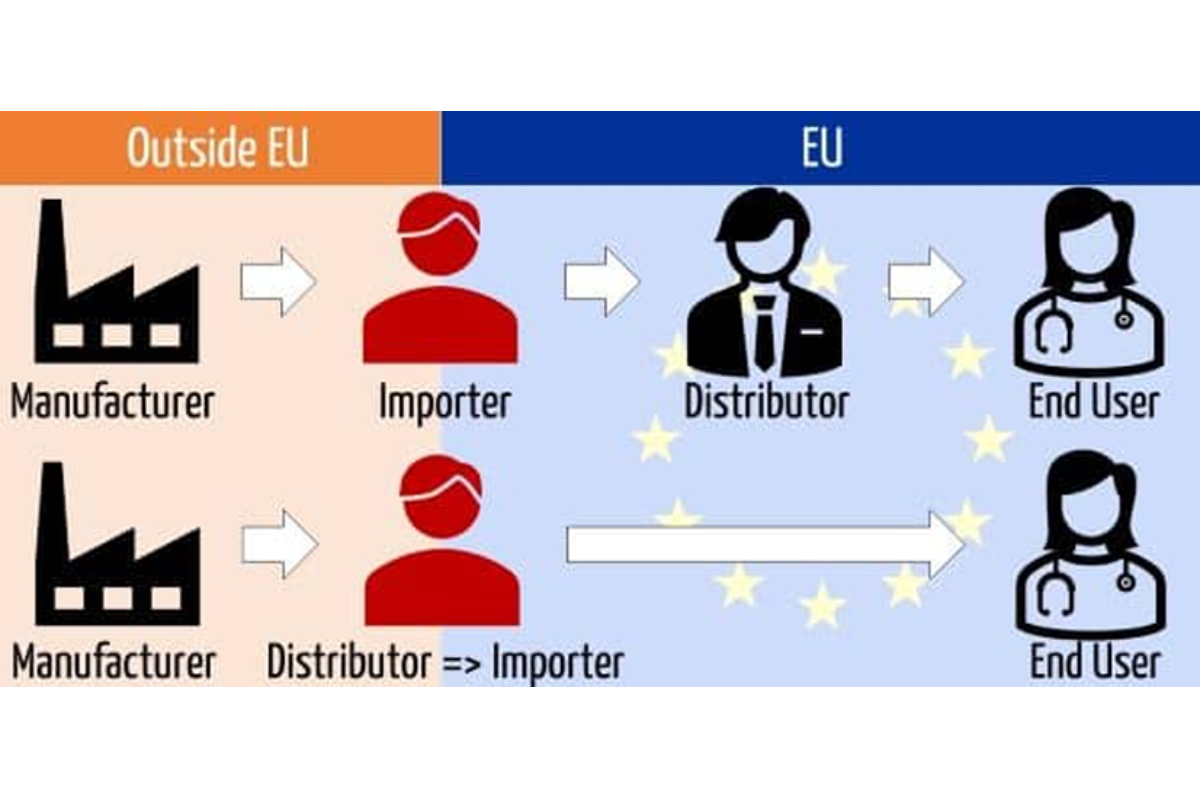

Different Types of Distributors and Pricing Considerations

Manufacturers must recognize the distinctions between various types of distributors, including wholesalers, distributors, and resellers, and tailor pricing strategies accordingly:

Wholesalers: Typically buy in bulk and serve as intermediaries between manufacturers and smaller distributors or retailers. Manufacturers might offer wholesalers discounted pricing to incentivize bulk purchases.

Distributors: Directly sell products to hospitals, clinics, and healthcare providers. Pricing for distributors should reflect their role in the supply chain and the level of value they provide.

Resellers: These entities buy medical devices from distributors or wholesalers and resell them to end users. Pricing for resellers can be influenced by factors such as volume and loyalty.

Acceptable Margin for Distributors

The acceptable margin for distributors can vary widely but is typically influenced by market conditions, competition, and the distributor’s level of investment. A standard margin might range from 15% to 30%. However, this can be higher in specialized markets or for distributors providing extensive value-added services.

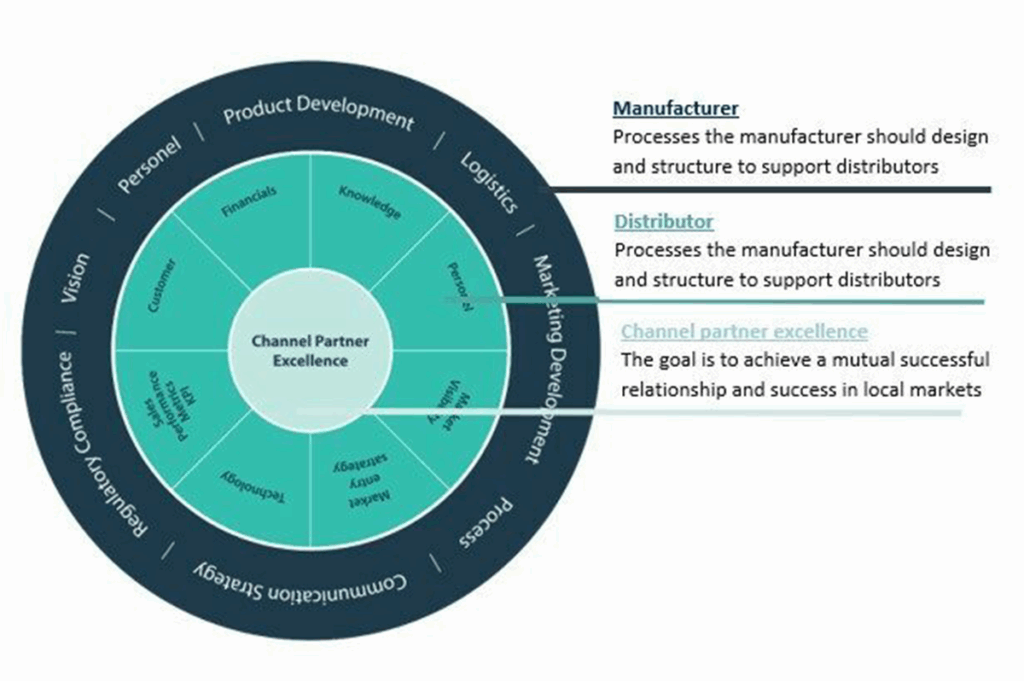

Incentive Plans for Medical Device Distribution

Motivating distributors is vital for success in international markets. Incentive plans can include volume-based bonuses, performance bonuses, and co-marketing support. Manufacturers should work closely with their distributors to align incentives with common goals, fostering a productive and mutually beneficial partnership.

Mastering medical device distribution in Europe and the Middle East involves careful consideration of pricing strategies, logistics, and distributor selection. Manufacturers must adapt their pricing to local market conditions, regulations, and the needs of their distributors. By working closely with the right distributors and offering competitive pricing, you can build strong, long-lasting partnerships that drive success in these promising international markets.

Contact GrowthMedics Today

GrowthMedics is an ISO 13485 market development provider specialized in assisting worldwide medical device manufacturers with their market expansion in European and Middle Eastern healthcare markets. We have developed and managed hundreds of distribution partnerships in 60+ markets.

Our sister company GrowthImports provides regulatory importing services in European and UK healthcare markets.

Email us or book a meeting with us. If you are interested in a free market scan you can apply here