The Spanish medical device (MED) market has grown to be worth €7.42 million, a number boosted by the government’s renewed support to the health sector owing to the pandemic. This blog will give a high level overview of the Spanish healthcare market. GrowthMedics has assisted numerous medical device companies expand their sales presence in Spain. If you are considering to expand In the Spanish healthcare market do feel free to reach out to us.

How Is Market Growth in the Spanish Healthcare Field?

Spain is divided into 17 autonomous regions and 50 provinces. Over 72% of the population use Castilian or Spanish language. The lack of English speakers makes the market more difficult to enter.

Spain uses Euros and charges a 21% VAT, higher than the OECD (Organisation for Economic Co-operation and Development) average.

Despite the Spanish healthcare market’s sluggish expansion, there was 13 percent growth from $9.748 million in 2019 to $10.990 million this year according to the International Trade Association (ITA).

Medical Trade Shows and Events

Spain hosts some of the most impressive pharmaceutical and medical trade shows in Europe.

- Infarma Madrid – the largest annual pharmaceutical and healthcare trade show in Madrid.

- ExpoDental – dubbed the largest dental conference and exhibition in Spain.

Competition

Spain’s healthcare system is reliant on imported products from the United States and Europe, particularly Germany. It is the fifth largest MED market in the European Union (EU). Here are a few big players to keep an eye on:

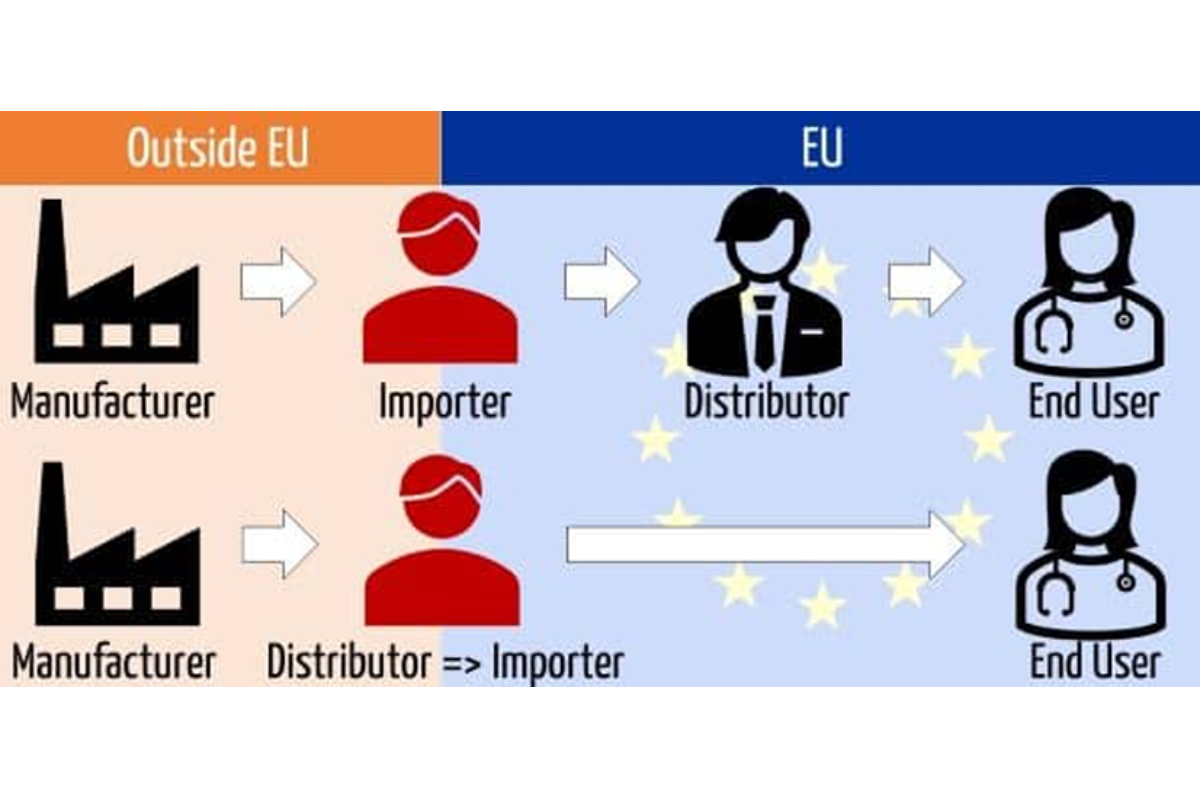

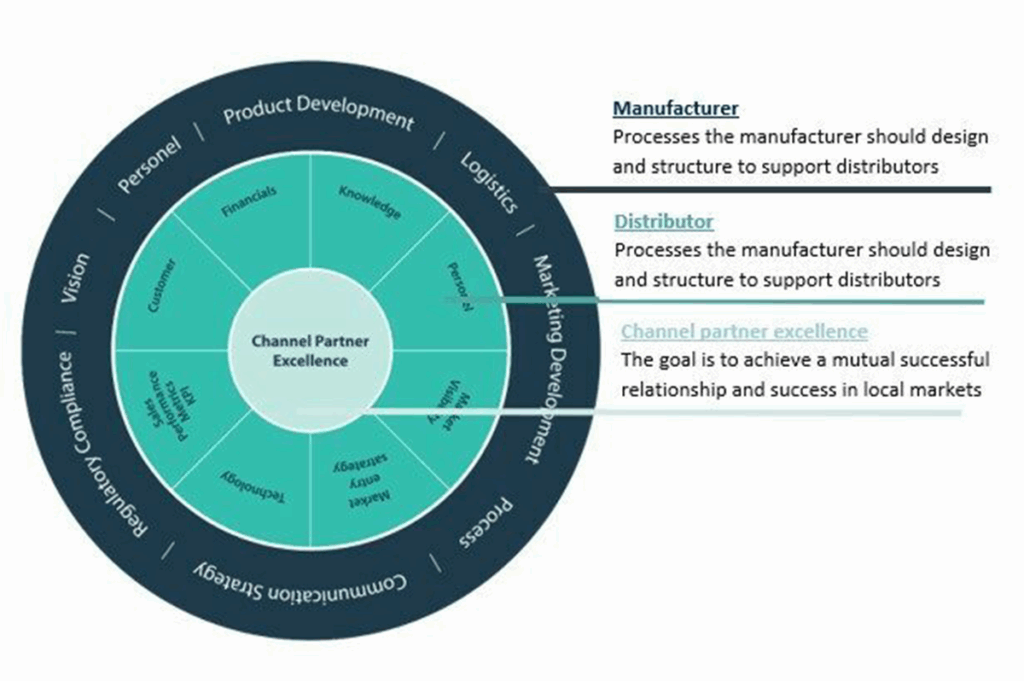

Distribution

Since the country uses official tenders for the majority of its public healthcare purchases, foreign companies should have their own branch or a local distributor to participate in the market. In the private sector, hospitals select suppliers that they purchase from directly.

The majority of the hospitals and clinics are located In the capital area Madrid and Catalonia, in the region of Barcelona. In most cases distributors focuses their efforts In their territories and Is a territory analysis when onboarding distributors advisable. Medical devices need a CE marking to legally enter the EU medical device market.

If you are looking to expand your presence through distributors or hospitals direct, feel free to reach out to us for more information.

What Is the Spanish Healthcare Expenditure Like Compared to the Rest of the EU and the World?

Spain has a lower than average expenditure at only 8.99% compared to the EU average of 9.87%. However, the government increased healthcare expenditure by 10 percent in 2021 to $270 billion in response to the global pandemic.

Analysts predict that Spain will continue to increase healthcare spending by another $12.23 billion by 2030. Investments in healthcare technology are expected to drive a 2.2 percent average yearly growth in expenditure.

Meanwhile, the global average healthcare expense is expected to reach $8.8 trillion this year especially in light of COVID-19.

Spanish Healthcare Statistics

Let’s look at Spain’s healthcare industry in terms of medical professionals and facilities.

Number of hospitals: 315 hospitals run by the Spanish National Health System (NHS) and around 465 privately-owned hospitals

Number of physicians: 111,800 physicians in 2018

Number of dentists: 34,000

Number of vets: around 6,000

Growth rate: Around 5%

Total imports in 2021: $9.5 million

Total exports in 2021: $4.4 million

Recently, the hospital university of Toledo was inaugurated with 853- bed capacity, 250 outpatient and exmination rooms and 25 operating rooms. It will be the biggest hospital in Europe.

Business culture In Spain

As previously mentioned in this blog, Spain is divided Into 17 autonomous regions with each their own cultures and some even have their own local language. Family and relationships are very Important. The concept of time and punctuality is not the same as in other western European countries. Meetings usually start late and end late, deadlines are postponed and working hours are usually until late, keeping in mind that usually between 1PM and 3PM many companies still have a ‘siesta’ (lunchbreak).

Negotiations can be lengthy and it is very common especially during lunch and social meetings. There are regional differences in negotiating styles for example in the south they appreciate a more traditional style of negotiation with bargaining.

Conclusion

Despite slow growth, the Spanish healthcare market has been growing steadily. The healthcare industry is reliant on imports as well as small and medium enterprises, and healthcare expenditure is expected to grow until 2030. 73% of foreign companies plan to increase or maintain their investments in the country. Expanding Into the Spanish market would require a localized approach where pricing remains to be sensitive.

All things considered, it’s easy to see why export-ready companies are encouraged to continue exploring investments in Spain, the EU’s fifth-largest MED market.

For your import and export needs, check out Growth Import.