The European orthopedic and spinal market has shown steady growth over the past years and is forecasted to continue a steady growth for the coming years. As a contract manufacturer or manufacturer of orthopedic and spine products looking to expand into Europe, this blog will share a brief overview of the market.

At GrowthMedics we have assisted numerous manufacturers in the orthopedic industry with their expansion in the European and Middle Eastern market. Reach out to us learn more about your opportunities and how we could assist.

Key considerations for the European Market:

1. Regulatory Compliance: A CE Marking Imperative

CE Marking Requirements: The European Union mandates CE marking for medical devices. The MDR regulations has increased the thresold and cost to enter, which contributed to low performing manufacturers to exit the EU market, offering opportunities for new manufacturers with appealing solutions. Approximately 500,000 medical devices need recertification under MDR, emphasizing the need for manufacturers to align with updated regulations.

2. Quality Standards: Securing ISO Certification

ISO 13485 Certification: ISO 13485 is the gold standard for quality management systems in medical device manufacturing in Europe. It is not always required but is surely the preferance of distributors and OEMs when engaging a partnership and will contribute to achieving your goals.

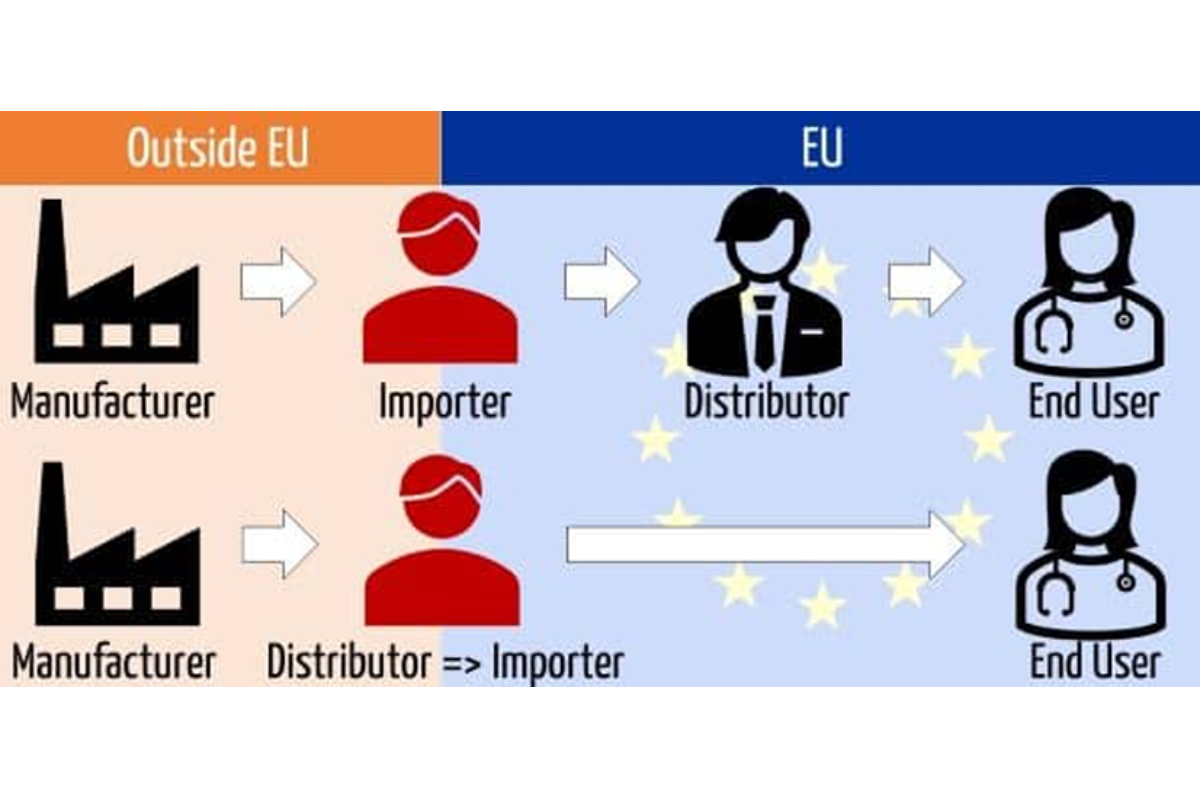

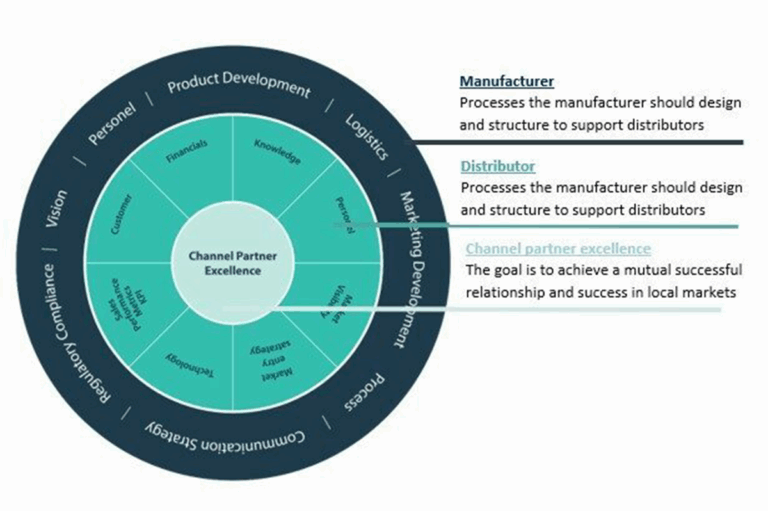

3. Distribution and Logistics: Building Efficient Channels

Establish Efficient Distribution Channels: Efficient distribution is key, considering the European medical device distribution market is valued at €30 billion. Partnering with experienced distributors is crucial for reaching healthcare providers and end-users effectively.

Logistical Considerations: Streamlining logistical processes is essential, given the intricate supply chain. Effective logistics contribute to timely and secure delivery, enhancing market penetration.

5. Building Relationships and Networking: Industry Collaboration

Attend Industry Events: Industry events provide unparalleled networking opportunities. AAOS 2024, with over 14,000 attendees, serves as a prime platform for connecting with key stakeholders and gaining industry insights.

Collaborate with Local Experts: Engaging with local experts is vital. Collaborating with regulatory consultants and industry associations ensures a nuanced understanding of the European market.

6. Financial Planning: Mitigating Risks

Understand Tariffs and Taxes: Import/export tariffs and taxes vary across European countries. Understanding these intricacies is vital for sound financial planning, especially considering the European orthopedic device market is projected to reach €14.3 billion by 2027.

Currency Considerations: Currency fluctuations can impact costs. Establishing financial protocols to mitigate risks associated with exchange rates is prudent.

European Orthopaedic & Spinal OEMs to watch out for in 2024:

1. Captiva Spine (United Kingdom) :

Captiva Spine, based in the UK, is an innovative startup focusing on spinal implant technologies. Known for its minimally invasive solutions, the company is gaining attention for its commitment to advancing spine surgery techniques.

2. Orthokey Italia (Italy):

Orthokey Italia, an Italian startup, is making waves with its orthopedic products designed for joint reconstruction and trauma surgery. The company’s emphasis on technological innovation and market responsiveness is contributing to its rapid growth. The company offers a range of orthopedic implants and instruments designed to meet the diverse needs of orthopedic surgeons and improve patient outcomes.

3. TiGenix (Belgium)

TiGenix, headquartered in Belgium, is a biopharmaceutical startup specializing in orthopedic and tissue engineering solutions. The company’s regenerative medicine approaches have garnered attention, positioning it as an emerging force in the orthopedic field.

4. Medovex (Ireland):

Medovex, operating from Ireland, is a startup dedicated to developing medical devices for the treatment of spinal conditions. The company’s flagship product is the DenerveX System, designed for the treatment of facet joint syndrome, a common cause of chronic back pain. The system offers a minimally invasive solution for patients suffering from this condition.

Major events in the industry in Europe 2024:

Event Overview: The European Federation of National Associations of Orthopaedics and Traumatology (EFORT) Congress is a flagship event, drawing orthopedic professionals from across Europe. With over 10,000 participants, it provides a comprehensive platform for knowledge exchange and discussions on the latest advancements in orthopedics.

Dates: 22-24 May, 2024

Location: Hamburg, Germany

2. EUROSPINE Annual Meeting – Navigating Spinal Innovations

Event Overview: The EUROSPINE Annual Meeting stands as a premier gathering for spine professionals. With more than 3,000 participants, it focuses on the entire spine care community, showcasing innovations, research, and collaborative opportunities in the spine industry.

Dates: 2-4 October, 2024

Location: Vienna, Austria

3. Medica – A Confluence of Medical Excellence

Event Overview: Medica, held annually in Düsseldorf, Germany, is the world’s largest medical trade fair. With a dedicated section for orthopedics and medical technology, it attracts over 5,500 exhibitors and 120,000 visitors. Medica serves as a comprehensive platform for exploring the latest trends and technological advancements in orthopedics and spinal care.

Dates: 11-14 November, 2024

Location: Dusseldorf, Germany

4. DGU Congress – Spotlight on Trauma Surgery

Event Overview: The German Society for Trauma Surgery (DGU) Congress is a key event for professionals in trauma surgery. With over 8,000 participants, it emphasizes advancements in trauma care, including orthopedic aspects. The congress offers a platform for sharing research, innovations, and best practices.

Dates: 25-28 September, 2024

Location: Leipzig, Germany

Click here to check out our industry expertise in the Orthopaedic & Spinal industry and how we help companies in their international expansion.

Ready to explore opportunities and discuss the future of orthopaedic and spinal solutions?

Click here to meet us at AAOS 2024 and schedule a meeting. We look forward to connecting with industry professionals, sharing insights, and forging partnerships that drive success in the dynamic landscape of European Orthopaedic and Spinal innovations. Let’s shape the future together.