As the fourth largest medical equipment market in Europe, Italy’s high profit per capita rate seems inviting to investors and foreign companies in the Italian healthcare market. The demand for cutting-edge medical devices is high, with the Italian government being the main purchaser of medical equipment.

At GrowthMedics, we’ve assisted various worldwide medical device manufacturers to expand their presence in the Italian healthcare market. This blog will provide high-level market information for guidance on understanding the market opportunities.

Growth In The Italian Healthcare Industry

Despite local manufacturers accounting for around 53% of the Italian medical device market, Italy still relies heavily on imports. In 2019, the market was valued at about $10.2 billion with about 75% of sales allocated to public hospitals.

What Is The Italian Healthcare Expenditure Like Compared To The Rest Of The EU And The World?

In 2020, Italy spent roughly 123.474 million Euros in healthcare. That’s 8.7% of their GDP, slightly below the EU average of almost 10% of the GDP. That’s about 2.534 Euros per inhabitant.

Statistics

75% of your market in Italy will consist of public hospitals while the rest will be a mix of private hospitals and clinics.

Number of hospitals – over 1,049

Private Hospitals – over 477

Public Hospitals – over 571

Number of physicians – around 242,000

Number of dentists – over 50,000

Growth rate – about 6.9%

Number of public medical universities – 13

Total imports in 2021 – about 6.890 million USD

Total exports in 2021 – around 4.957 million USD

In 2021, the estimated total market size of the Italian MED trade rose to around 10.710 million USD.

The most popular public hospitals include:

- Grande Ospedale Metropolitano Niguarda

- Poloclinico Universitario A. Gemelli

- Instituto clinico Humanitas

Who are the leading medical device companies?

Italy has about 4,323 medical device companies with a workforce of over 94,153.

The leading companies are:

- Milan-based manufacturer of hearing aid devices Amplifon

- Multinational healthcare firm Bracco

- Biotech company DiaSorin with its focus on diagnostic testing.

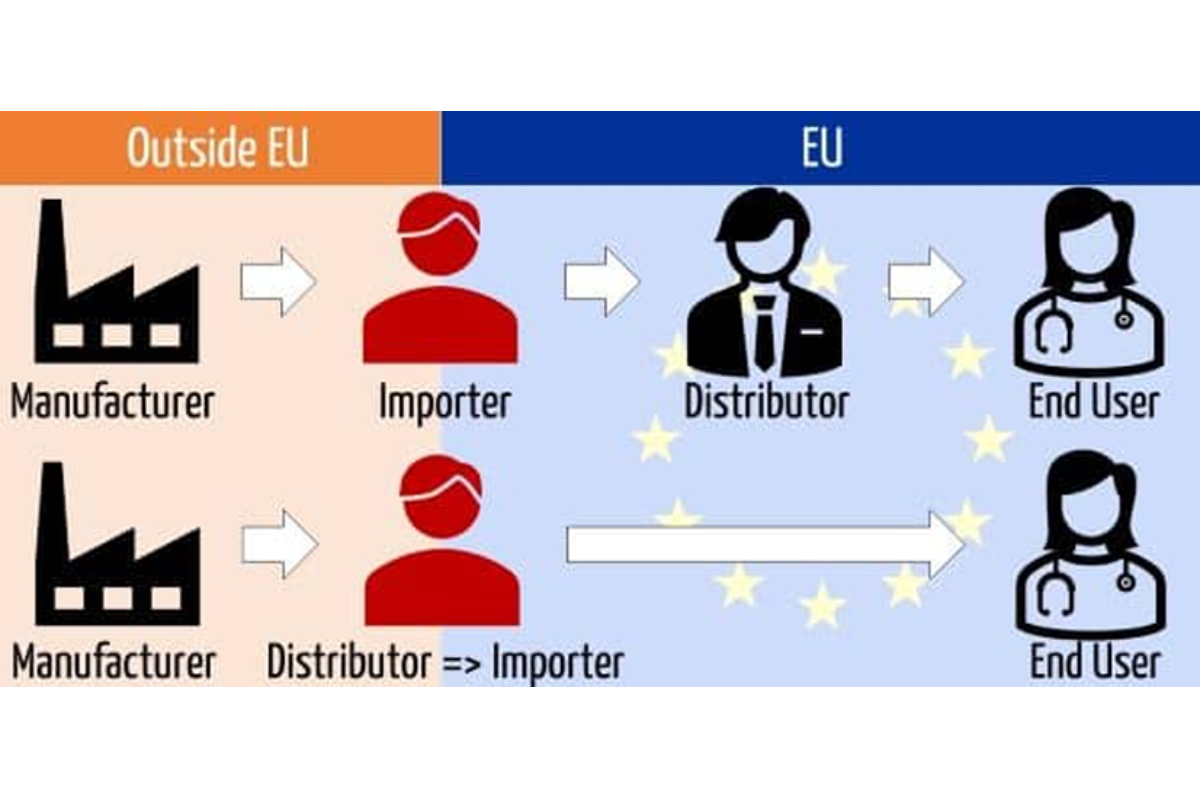

Distribution

Subdivided into 20 regions, the Lombardia area in Italy with a population of about 10 million accounts for the largest medical device market in the country. Many distributors position themselves in Lombardy, Veneto, and Emilia-Romagna.

Trade in the South is poorer and is conducted through sub-dealers. You could benefit from any experience in trading in Greece and Spain while transacting business in Southern Italy due to the similarities.

Biggest Medical Device Tradeshow Events in Italy

Seven main medical tradeshows take place in Italy. The main tradeshow events are:

Expodental – To be held on May 18, to 20, 2023.

CPHI Worldwide – Expected to happen in October 2023.

P-MEC Worldwide – Scheduled to take place in October 2023.

Business Culture

Italy holds the 98th rank in the EU for ease of doing business. The business culture is hierarchy driven.

Personal and professional relationships are emphasized—connections and third-party introductions are important.

Business transactions are mostly conducted in English. Italians take time with decision making and negotiations.

What to consider when doing business with the Italian healthcare market?

Regardless of the emphasis on local production and export, imported products are well received. High-end, cost-effective diagnostic imaging and patient aid solutions are in demand.

Conclusion

The Italian market is tricky to get into without the right resources and connections. Despite corruption, high taxation, and political interference, Italy offers a great gateway to other global markets.

If you are looking to expand your presence in the Italian healthcare market, reach out to us and GrowthImports for your import and export needs.