Germany is home to some of the most renowned medical device manufacturers in the world. A “made in Germany” stamp is synonymous with excellence and quality, but this reputation hasn’t deterred foreign companies from entering the German healthcare market. The country’s medical device (MED) trade is governed by strict regulations designed to maintain quality and ensure fair competition for all. At GrowthMedics, we have helped numerous medical device companies navigate the complexities of the German healthcare market.

In this article, we provide a comprehensive overview of Germany’s healthcare landscape, key trends, and actionable steps for businesses looking to expand. If you are considering entering this market, feel free to reach out for expert guidance.

Growth of the Healthcare Industry in Germany

Germany’s healthcare system is one of the most advanced in Europe, supported by a strong infrastructure and consistent investment. The country is divided into 4 zones, reflecting its historical East-West divide. While 95% of the population speaks German and uses the Euro, there is still a notable lack of English speakers, particularly among older generations.

Resilience and Growth Amid Challenges

Unlike other markets, such as Italy, Germany’s medical device market demonstrated remarkable resilience during economic downturns and the COVID-19 pandemic. According to Fitch Solutions, the German medical device market is projected to grow between 5.1% to 6.8% annually until 2025. This growth is supported by steady government expenditure on healthcare and a strong focus on innovation.

Key considerations for companies:

- All medical devices require CE marking before they can be sold.

- The German market imposes a 19% VAT on medical devices.

- Companies must adhere to stringent EU MDR regulations.

German Healthcare Expenditure: A Leader in the EU and Beyond

Germany’s healthcare expenditure is among the highest globally. In 2019, Germans spent €410.8 billion (over $379 billion) on healthcare, representing 11.2% of the GDP. By comparison, the average expenditure among OECD countries is around 10%.

This high expenditure highlights Germany’s commitment to quality healthcare and creates opportunities for medical device distributors and manufacturers seeking to enter the market.

Key Statistics: Germany’s Healthcare Landscape

Germany is a global leader in healthcare infrastructure, medical supplies, and technology. Consider these statistics when evaluating the market:

- Number of hospitals: Approximately 2,000

- 50% are public hospitals (including 30% university hospitals).

- 50% are private hospitals, with a mix of for-profit and nonprofit organizations.

- Top hospital groups:

- Universitätsklinikum Heidelberg

- Asklepios Kliniken

- Universitätsklinikum Hamburg-Eppendorf

- Number of physicians: 515,640

- Number of dentists: Over 97,000

- Number of veterinarians: Around 41,000

- Market growth rate: 5.1% to 6.8%

The COVID-19 pandemic further accelerated demand for medical devices, solidifying Germany’s position as one of the largest markets in the world.

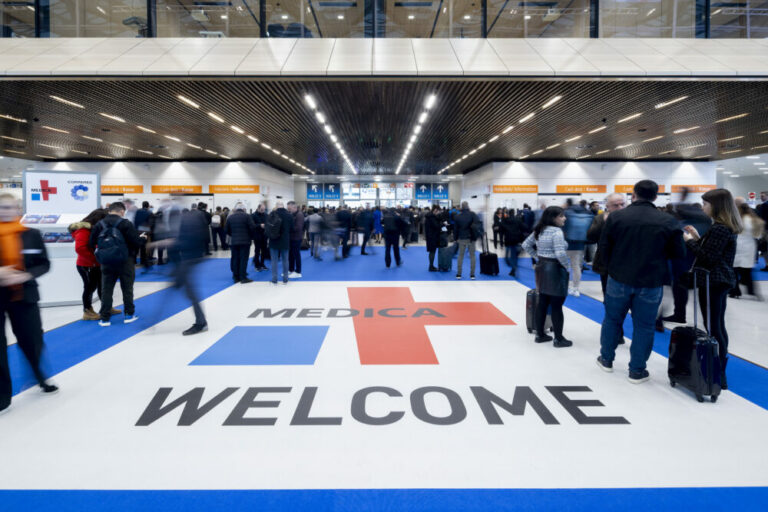

Trade Shows and Events to Watch

Germany hosts some of the most influential trade shows in the medical device industry. These events provide opportunities to connect with medical device distributors in Germany, manufacturers, and key decision-makers:

- MEDICA: The world’s largest medical trade fair.

- IDS: Focused on dental devices and technology.

- REHACARE: Dedicated to rehabilitation and assistive technologies.

Stay updated on industry news by leveraging platforms like LinkedIn and Xing, which are widely used by German professionals.

Navigating the Competitive Landscape

With over 3,331 registered medical device companies, competition in Germany is fierce. Leading players in the market include:

- MAQUET GmbH (Rastatt)

- Erbe Elektromedizin GmbH (Tübingen)

- Storz Endoskop Produktions GmbH (Tuttlingen)

- BIOTRONIK SE & Co. KG (Berlin)

Distribution Networks and Medtech Hubs

Germany’s healthcare market is supported by robust distribution networks and specialized medtech hubs. For example:

- BioConValley: A hub with 50 companies, 5 universities, and 12 research institutes focused on biotech and healthcare.

- Life Science Nord: Comprising 500 companies, 2 university hospitals, and 8 universities, this hub emphasizes innovation in medical technology.

- Medical Valley EMN: Over 500 companies and 21 research institutes, focusing on cutting-edge medical advancements.

Regional Insight: Nordrhein-Westfalen has the highest concentration of hospital beds in Germany, accounting for 21% of the country’s total capacity.

When entering the market:

- Partner with local distributors such as TROGE Medical, MIB, or BASISMETALL.

- Invest in language translation services to adapt materials and improve communication with German partners.

Conclusion: Why Germany Should Be on Your Radar

Germany’s medical device market combines a strong domestic manufacturing base with a growing demand for imports. The projected growth of 5.1% to 6.8% over the next four years, coupled with increasing healthcare expenditure, makes Germany one of the most lucrative markets in Europe.

Entering this market requires preparation, from understanding regulatory requirements to identifying the right medical device distributors. GrowthMedics is here to support your journey. With our expertise in the German healthcare market, we’ll help you navigate challenges and seize opportunities.

Contact us today to learn how we can assist with your expansion into Germany.

Why Choose GrowthMedics?

- Proven experience in helping companies expand into Germany.

- Deep knowledge of EU MDR and German healthcare regulations.

- Strong network of local distributors and medtech hubs.

Let us be your partner in unlocking the potential of the German healthcare market.