Unlocking Opportunities in European Anaesthesia Market

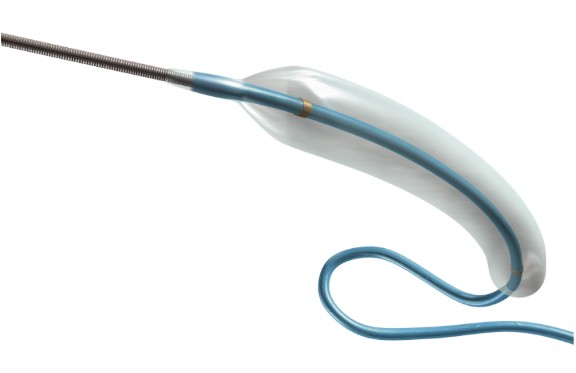

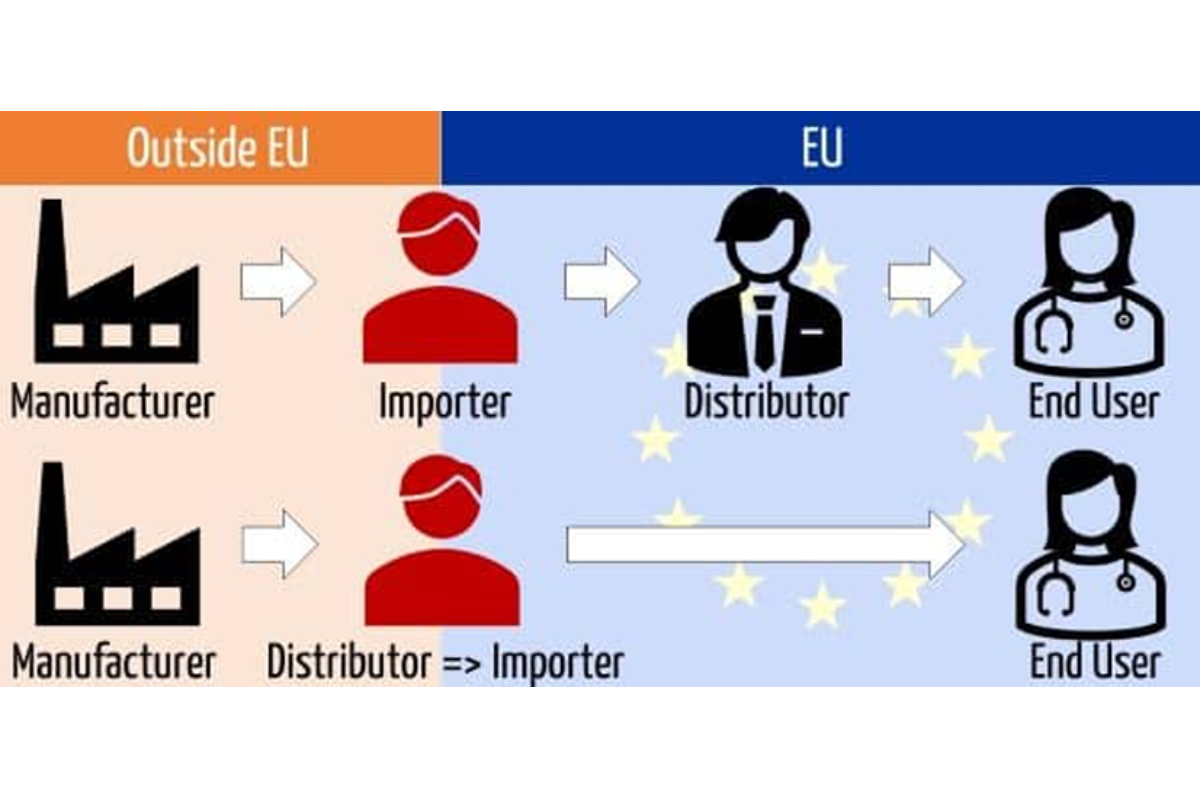

European Anesthesia Market Overview The European medical technology market as a whole is enormous – about €170 billion in 2024, making Europe the world’s second-largest medtech market after the US. Within this, anesthesia-related products form a vital segment, as every surgical procedure requires some form of anesthesia. The demand for anesthesia machines, monitoring equipment, anesthetic drugs, and single-use consumables is growing steadily across Europe, driven by an aging population and high surgical volumes. In fact, the European anesthesia equipment market is expected to grow at roughly 9% annually through 2030. Likewise, the market for anesthesia drugs in Europe is rising – from an estimated €4.2 billion in 2024 to €6.3 billion by 2031 (about 5% CAGR). This growth outlook underscores that Europe’s need for anesthesia products is increasing year by year. With GrowthMedics, we recently partnered with an anesthesia manufacturer to successfully enter the European market, guiding them through MDR and CE certification, appointing the right local representatives, and building a strong distributor network that allowed them to secure hospital contracts and establish a solid presence across multiple key European countries. Key Demand Drivers & Trends 1) More surgeries & outpatient shift Surgical volumes are growing, with a sustained move toward day-case procedures. Ambulatory settings need compact, easy-to-deploy anesthesia machines and monitoring setups that turn rooms faster and support minimally invasive workflows. 2) Aging population & chronic disease More cardiovascular, oncologic, and orthopedic interventions drive anesthesia use. Older, multi-morbid patients increase the need for advanced monitoring (depth of anesthesia, neuromuscular, hemodynamics) to reduce complications and length of stay. 3) Smart & integrated monitoring Hospitals are standardizing on connected anesthesia workstations and analytics-enabled monitors that feed OR/EMR systems in real time. Decision-support features (e.g., anesthetic depth guidance) help optimize dosing, reduce drug use, and improve recoveries. 4) Portability & remote readiness Compact, battery-backed anesthesia equipment and wireless monitors extend safe anesthesia care beyond main ORs – to day-surgery suites, smaller clinics, and transport scenarios – supporting decentralized care models. 5) Outcomes, cost, and sustainability Procurement favors solutions that demonstrably cut complications, shorten PACU time, and trim gas consumption (and emissions). User-friendly interfaces matter amid staffing constraints; automation that simplifies set-up and monitoring gains traction. Market Entry & Compliance The path to entering the European anesthesia market requires non-EU manufacturers to first achieve MDR compliance and CE certification, processes that are complex, time-consuming, and demand significant investment in clinical evidence and quality systems. Companies must also appoint an Authorized Representative and an Importer within the EU, keeping these roles separate from distributors to ensure proper compliance management. Beyond regulation, success relies on local adaptation: translated labels and instructions, tailored pricing strategies, and a solid understanding of country-specific procurement systems. Equally important is providing comprehensive support, from clinical training to maintenance contracts, in order to build trust and compete effectively with established players. Figure 2 – Spinal anesthesia Attractive European Markets for Anesthesia Products Germany – Europe’s largest hospital base and technology adopter; high surgical throughput and strong budgets. Competitive but highly influential once referenced. France – Large public system, strong safety culture, and solid growth in anesthesia equipment; be prepared for tenders and full French localization. United Kingdom – Outside the EU but a top European buyer with innovation-friendly NHS/private mix; plan for UKCA alongside CE during the transition. Italy & Spain – Big, upgrading markets with growing private segments; regional nuances and local-language sales/after-sales coverage are vital. Poland & CEE – Fastest growth, high import reliance, and active modernization programs; attractive for value-engineered, quality solutions and agile distributors. Key Upcoming Anesthesia Tradeshows and Congresses At GrowthMedics, we support manufacturers in gaining visibility at key tradeshows and congresses. Notable upcoming events include the ESPA 2025 Congress in Berlin (2–4 October 2025), the ESRA Italy National Congress in Florence (23–25 October 2025), and Euroanaesthesia 2026 in Copenhagen (30 May–2 June 2026). These are complemented by broader platforms such as MEDICA 2025 in Düsseldorf (17–20 November) and Anaesthesia 2026 in Brighton (12–14 May). How GrowthMedics Can Help At GrowthMedics, we specialize in helping non-EU anaesthesia manufacturers enter the European market efficiently. We assist with everything from regulatory navigation to distributor selection and sales development strategies. By combining our local expertise with hands-on support, we help manufacturers reduce risks and accelerate their market success.