European IV Market Overview

IV access products are a cornerstone of modern healthcare, as intravenous therapy is used daily across hospitals and clinics for hydration, medication delivery, chemotherapy, and nutrition. The demand for IV catheters, infusion pumps, IV solutions, and single-use consumables continues to grow steadily across Europe, driven by an aging population, a rising prevalence of chronic diseases, and the expansion of outpatient and home-based care. The European IV therapy market is projected to expand at around 6–7% annually through 2030, reflecting its essential role in patient treatment and ongoing investments in safer, smarter, and more efficient infusion solutions.

With GrowthMedics, we recently supported an IV therapy manufacturer in successfully entering the European market – guiding them through MDR and CE certification, appointing trusted local representatives, and building a strong distributor network that helped them secure hospital contracts and establish a lasting presence across several key European countries.

Key Demand Drivers & Trends

Growing chronic disease burden – Europe faces high rates of cancer, diabetes, and cardiovascular diseases, all of which require long-term IV therapies for hydration, nutrition, chemotherapy, or drug delivery.

Aging population – An older patient base requires more frequent hospitalizations, surgeries, and supportive care, making IV products a backbone of modern treatment.

Shift to outpatient and home care – Increasingly, IV therapies are being administered outside of traditional hospitals, driving demand for portable and user-friendly infusion devices and secure IV disposables that ensure patient safety in home settings.

Focus on safety and infection prevention – With EU hospitals prioritizing lower infection rates, there is strong demand for closed-system transfer devices, needle-free connectors, and antimicrobial catheters. Products that minimize contamination risks are gaining adoption.

Smart infusion technology – Hospitals are adopting smart pumps with wireless connectivity, dose error-reduction systems, and integration with electronic health records to enhance patient safety and reduce medication errors.

Market Entry & Compliance

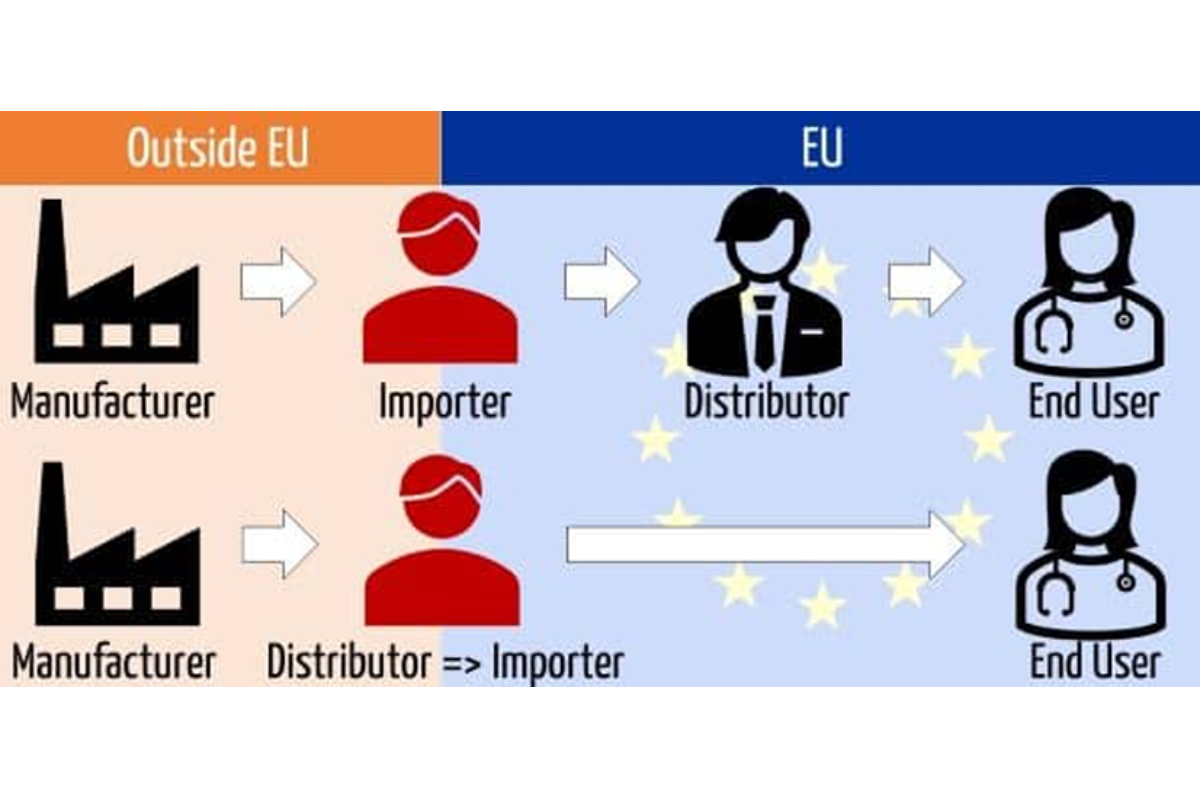

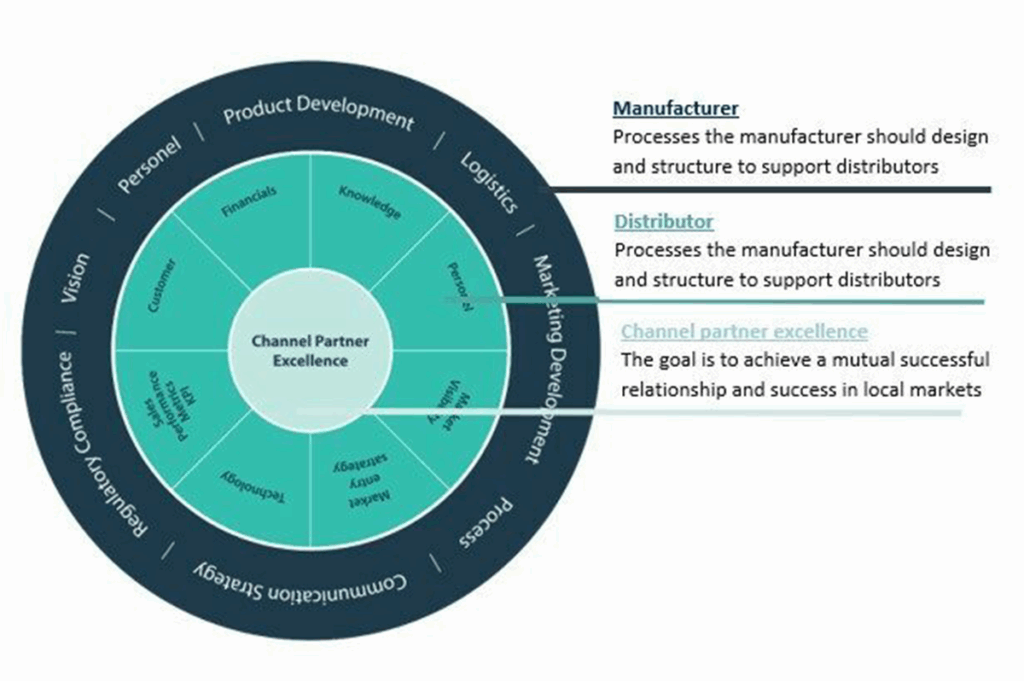

The path to entering the European IV therapy market requires non-EU manufacturers to achieve MDR compliance and CE certification. These processes are complex, time-intensive, and require investment in clinical evidence and robust quality systems. Companies must also appoint an Authorized Representative and an Importer within the EU, ensuring these roles remain separate from distributors to maintain compliance and avoid conflicts of interest. Beyond regulation, success depends on local adaptation: translated instructions and labeling, tailored pricing aligned to country-specific procurement systems, and reliable after-sales service. Offering clinical training and technical support is equally important to build trust and effectively compete with established suppliers.

Figure 2 – Market Concentration (Mordor Intelligence)

Figure 2 – Market Concentration (Mordor Intelligence)

Attractive European Markets for IV Products

- Germany – Europe’s largest healthcare market with significant investments in infusion technology and hospital infrastructure. German hospitals are highly receptive to smart infusion systems and advanced disposables.

- France – A strong public healthcare system and large patient population make France a core market. Centralized procurement favors suppliers with proven reliability and capacity to scale.

- United Kingdom – Despite its post-Brexit regulatory pathway (UKCA), the NHS is a major buyer of IV products, particularly smart pumps and safety-focused disposables.

- Italy & Spain – Both countries face rising chronic disease prevalence and are investing in modernizing hospitals and expanding home care, creating strong demand for infusion devices and consumables.

- Poland & Central/Eastern Europe – Rapidly growing markets with heavy reliance on imports. Cost-effective, high-quality IV solutions and disposables are especially attractive here, offering high growth potential.

How GrowthMedics Can Help

At GrowthMedics, we specialize in helping non-EU Intravenous Therapy manufacturers enter the European market efficiently. We assist with everything from regulatory navigation to distributor selection and sales development strategies. By combining our local expertise with hands-on support, we help manufacturers reduce risks and accelerate their market success.